texas estate tax return

Texas estate tax return Monday March 21 2022 Edit. Form 706 estate tax return.

Each are due by the tax day of the year following the individuals death.

. A tax return is required if the deceased person received at least a minimum amount of income set by federal law each year in the last year of life. Fuels Tax IFTA and Interstate Truckers. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them.

Regarding the beneficiaries in general an inheritance in and of itself is not considered income so you wont have to report your. The current exemption doubled under the Tax Cuts. Whether you have a 50000 or 5000000 house you will owe real property taxes in Texas.

Theres a Decedents estate box at the top the form which you should check. Filing Form 4768 automatically gives the executor of an estate or the trustee of a living trust an additional six months to file a tax return. Before filing Form 1041 you will need to obtain a tax ID number for the estate.

Form 4768 must be filed on or before the due date for Form 706 or for the equivalent form for a given estate. The estate executor must file an estate tax return when the gross estate meets or exceeds the filing threshold based on the date of death. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF.

Theres no personal property tax except on property used for business purposes. You can file your franchise tax report or request an extension of time to file online. The executor of the estate is responsible for filing a Form 1041 for the estate.

These tax rates can add up to 2 to the state sales tax making the combined total tax rate as high as 825 on purchased items. An estates tax ID number is called an employer identification number or EIN and comes in the format 12-345678X. If your real property was purchased mid-year there is a chance your realtor will work it out that you and the seller split the cost of real property taxes within the.

Its inheritance tax was repealed in 2015. Counties cities transit and special purpose districts have the option to impose additional local sales and use taxes. When the gross estate is less than the filing threshold no estate tax return is required.

As of the Effective Time the Surviving Corporation hereby assumes all obligations of Ascendant-Texas for any franchise taxes or franchise tax returns. There is no minimum or maximum amount of real property taxes you could owe in Texas. Also note the estates income tax return is different from the estate tax.

Estate Tax Interest Calculator. The court will appoint an executor to manage the estate during this process. There is a 50 penalty for a franchise tax report filed after the due date even if no tax is due with that report and even if the taxpayer subsequently files the report.

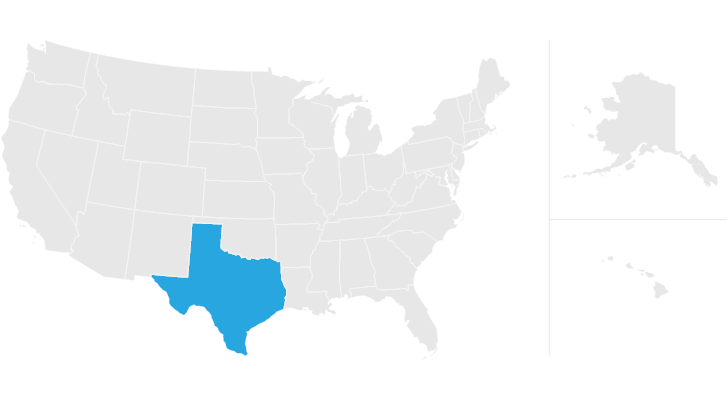

The decedent and their estate are separate taxable entities. Texas has no income tax and it doesnt tax estates either. One on the transfer of assets from the decedent to their beneficiaries and heirs the estate tax and another on income generated by assets of the decedents estate the income tax.

Up to 25 cash back You as executor can file the estates first income tax return which may well be its last at any time up to 12 months after the death. On it youll report estate income gains and losses and will claim deductions for the estate. Texas has a state sales tax rate of 625.

Texas also imposes a cigarette tax a gas tax and a hotel tax. If your address has changed please update your account. Texas state and local governments generate revenue.

The Estate Tax is a tax on your right to transfer property at your death. To expedite the processing of your tax returns please file electronically or use our preprinted forms whenever possible. Personal Income Tax State and Federal Most executors must file final state and federal income tax returns for the calendar year in which the deceased person died.

Applications for Tax Exemption. If you die without a will in the state of Texas and your estate is worth more than 75000 it will go into probate. Dying Without a Will.

20 The estimated tax should be paid by that date as well. The sales tax is 625 at the. As executor you would have to file a Form 1041 Income Tax Return for Estates and Trusts if the estate had either gross income of 600 or more for the tax year or one or more beneficiaries is a nonresident alien.

Texas does not have an income tax code. Any income generated by the decedent after the date of death should be reported on the estates income tax return rather than on the decedents personal income tax returns. Agricultural and Timber Exemption Forms.

The size of the estate tax exemption meant that a mere 01 of estates filed an estate tax return in 2020 with only about 004 paying any tax. The sales tax is 625 at the state level and local taxes can be added on. Form 1041 is only required if the estate generates more than 600 in annual gross income.

Texas Franchise Taxes and Franchise Tax Returns. If the deceased persons estate earned income after the date of their death such as interest on a bank account or dividends from investments you may need to file a second income tax return Form 1041 for estates and trusts. Texas has a state sales tax rate of.

Depending on the circumstances you may need to file additional forms. Tax Forms - The estate tax return and instructions ET 2 and all other estate tax forms are here. Annual Report PDF - The estate tax chapter from the Ohio Department of Taxations annual report is here.

Interest Rates - The interest rate that applies to overdue taxes changes each year. Form 706 estate tax return. Power of Attorney Forms.

Most Frequently Used Tax Forms Sales and Use Tax. The return is filed under the name and taxpayer identification number TIN of the estate. The federal estate tax return is due within nine months of your death.

A six-month extension is available for this return as well. Does Texas have an estate tax. You can apply online for this number.

Texas Estate Tax Everything You Need To Know Smartasset

Texas Inheritance And Estate Taxes Ibekwe Law

Where Are The Best Schools In Austin

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Cypress Texas Property Taxes What You Need To Know

When Are Property Taxes Due In Texas Find The Texas Property Tax Due Dates More Tax Ease

Texas State Taxes Forbes Advisor

Capital Gains Tax On Property Sales In Texas Tom S Texas Realty

Texas Estate Tax Everything You Need To Know Smartasset

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

2021 Extended Tax Returns Texas Franchise Due Date Beaird Harris

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes

Texas Estate Tax Everything You Need To Know Smartasset

Which States Have The Lowest Property Taxes

State Corporate Income Tax Rates And Brackets Tax Foundation